Navigating the financial landscape can be challenging; find the perfect guide with our expert tips...

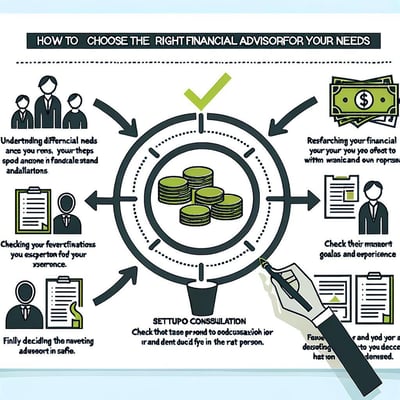

How to Choose the Right Financial Advisor for Your Needs

Navigating the complex world of financial planning can be daunting. Choosing the right financial advisor is crucial for ensuring your financial goals are met with expertise and personalized attention.

Understanding Different Types of Financial Advisors

Selecting the right financial advisor begins with understanding the various types available. Advisors can differ significantly in their investment styles. Some may adopt a conservative approach, focusing on preserving capital, while others might lean towards aggressive strategies aimed at maximizing returns. It's crucial to align your advisor's investment style with your own risk tolerance and financial goals.

Tax minimisation is another important aspect to consider. A proficient advisor will implement strategies to reduce your tax liabilities, thereby increasing your net returns. Look for advisors who demonstrate a comprehensive approach to tax planning, incorporating it seamlessly into their overall strategy.

Flexibility is key in financial planning. Your financial advisor should be adaptable, capable of adjusting strategies as your personal circumstances or market conditions change. This flexibility ensures your financial plan remains robust and relevant over time.

Identifying Your Financial Goals and Needs

Before engaging a financial advisor, it's essential to have a clear understanding of your financial goals and needs. Are you planning for retirement, saving for your children’s education, or looking to grow your wealth? Knowing your objectives will help you find an advisor whose expertise aligns with your specific requirements.

Take the time to assess your financial situation, including your assets, liabilities, income, and expenses. This self-assessment will provide a solid foundation for discussions with potential advisors, ensuring they understand your unique financial landscape and can tailor their advice accordingly.

Evaluating Qualifications and Experience

The qualifications and experience of a financial advisor are critical indicators of their capability. Look for advisors with recognized certifications such as Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA). These designations signify a high level of expertise and commitment to ethical standards.

Experience is equally important. An advisor with a proven track record in managing portfolios similar to yours can provide valuable insights and strategies. Don’t hesitate to ask for references or case studies that demonstrate their success in helping clients achieve their financial goals.

Assessing the Advisor's Approach to Client Relationships

A financial advisor's approach to client relationships can greatly impact your experience. Ideally, your advisor should prioritize transparent communication, offering clear explanations and regular updates about your financial plan’s progress.

Consider how the advisor plans to engage with you. Will they be available for regular check-ins, or do they prefer a more hands-off approach? Understanding their communication style and availability will ensure that your expectations are aligned and that you feel supported throughout your financial journey.

Steps to Take Before Making Your Final Decision

Before finalizing your choice, conduct thorough due diligence. Schedule initial consultations with multiple advisors to compare their approaches, fees, and compatibility with your financial goals. This comparative analysis will help you make an informed decision.

Review the advisor's fee structure carefully. Understand how they are compensated—whether through commissions, flat fees, or a percentage of assets under management—and ensure there are no hidden costs. Transparency in fees is crucial to avoid potential conflicts of interest.

Finally, trust your instincts. Your financial advisor will play a significant role in your financial well-being, so it's important to choose someone you feel comfortable with and confident in. Taking these steps will help you select an advisor who not only meets your technical needs but also aligns with your personal values and communication preferences.

The information provided on and made available through this website is general in nature and has been prepared without taking into account your objectives, financial situation or needs – it may not be appropriate to your situation. Before acting on this information, you should consider it’s appropriateness to your personal situation. The information provided is not intended as, nor is it a substitute for, personal or institutional financial services advice.

We recommend that you obtain your own independent professional advice before making any decision in relation to your particular requirements or circumstances. Before acquiring any financial product, you should obtain the relevant Product Disclosure Statement (PDS) for any product mentioned and consider its contents before making any decision. Past performance of any product discussed on this website is not indicative of future performance. We do not warrant that any future forecasts are guaranteed to occur